By Aaron Devitt, Co-Founder

The convergence of Black Friday, Cyber Monday, Christmas, and Boxing Day sales creates unprecedented opportunities in UK electronics retail. With UK consumers expected to spend £8.7bn during Black Friday weekend alone, and electronics consistently ranking as the top category for holiday purchases, optimising the in-store experience is crucial for capturing market share.

Critical Challenges in Consumer Electronics Retail

Peak season in consumer electronics retail presents unique challenges that require careful consideration and strategic planning. These challenges are particularly acute during the concentrated shopping peaks of Black Friday, Christmas, and Boxing Day sales.

The complexity begins with high-value purchases, where customers expect and require detailed consultation before committing to significant investments. Whether it's the latest QLED television or a premium laptop, customers need knowledgeable staff who can provide comprehensive guidance while managing time efficiently during peak footfall.

Product demonstrations add another layer of complexity to the shopping experience. Today’s electronics often require hands-on interaction to showcase their features effectively. Managing these demonstration areas during high-traffic periods becomes crucial, especially when multiple customers need simultaneous access to popular items like the latest smartphones or gaming consoles.

“78% of customers expect staff to demonstrate products before purchasing items over £200 (Consumer Electronics Association, 2023)”

Security considerations for premium items cannot be overlooked during peak season. With higher stock levels of valuable merchandise on display, retailers must balance accessibility for legitimate customers with robust loss prevention measures. This challenge intensifies when stores are at their busiest and staff attention is divided.

“92% of electronics retailers reported security incidents during Black Friday 2023”

Technical support requirements don't diminish during peak periods – if anything, they increase. Customers still need assistance with existing purchases while new buyers require initial setup guidance, creating additional pressure on support staff who must maintain service quality despite the surge in demand.

Extended warranty sales represent a significant revenue opportunity but require delicate handling during busy periods. Staff must strike the right balance between offering these valuable additions without extending transaction times to the point where they impact queue management.

Click & Collect fulfilment has become increasingly critical, with many customers preferring to secure their purchases online before visiting stores. Managing this service effectively during peak periods requires precise inventory management and efficient pickup processes to prevent in-store congestion.

“Click & Collect services saw a 156% increase during peak season 2023”

Understanding these fundamental challenges is only the first step. The key to success lies in implementing rapid, effective solutions that address these issues while maintaining operational efficiency. With limited time before the peak season begins, retailers need prioritise actions that deliver maximum impact with minimal disruption. Our immediate implementation strategies provide a framework for addressing each of these challenges systematically, focusing on solutions that can be deployed quickly while delivering meaningful results.

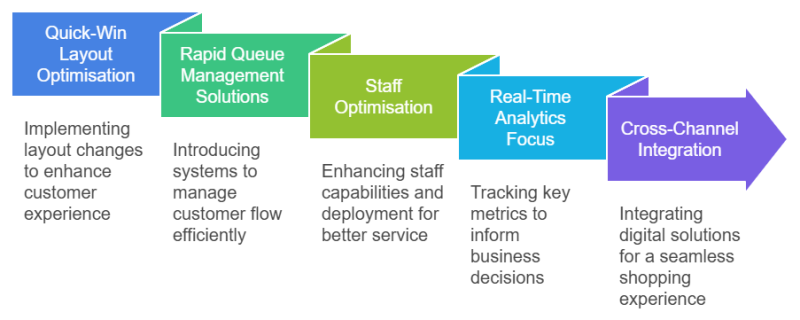

Immediate Implementation Strategies

1. Quick-Win Layout Optimisation

Implement within 48 hours:

- Create clear demonstration zones for flagship products

- Establish dedicated Click & Collect points

- Position promotional items near store entrance

- Install digital wayfinding solutions

- Set up express lanes for accessories

2. Rapid Queue Management Solutions

Deploy within one week:

- Mobile POS systems for queue-busting

- Digital queue management for consultation areas

- WhatsApp notification system for collection

- Separate queuing for returns/support

- Express checkout for sub-£100 purchases

3. Staff Optimisation

Immediate actions:

- Cross-train staff on high-demand products

- Deploy product specialists during peak hours

- Implement mobile knowledge bases

- Create dedicated demo teams

- Position greeters for queue management

4. Real-Time Analytics Focus

Priority metrics to track:

- Conversion rates by product category

- Dwell time in demonstration areas

- Click & Collect wait times

- Sales per staff member

- Returns rate monitoring

5. Cross-Channel Integration

Quick deployment solutions:

- QR codes for product specifications

- Digital price matching

- Stock checking via mobile app

- Reserve & Collect service

- Digital receipt options

While these cross-channel integration elements form the backbone of a modern retail operation, the immediacy of peak season demands a structured approach to implementation. With Black Friday looming and Christmas trading on the horizon, retailers need a clear, week-by-week action plan to deploy these optimisations effectively. The following Emergency Response Protocol provides a detailed roadmap for the crucial weeks ahead, prioritising quick wins while building towards comprehensive system integration.

Emergency Response Protocol

For immediate deployment:

1. Week One (Now):

- Staff training intensification

- Layout adjustments

- Queue management system setup

2. Black Friday Week:

- Real-time monitoring

- Dynamic staff reallocation

- Hourly performance reviews

3. Christmas to Boxing Day:

- Refined operations based on Black Friday learnings

- Adjusted staffing patterns

- Enhanced Click & Collect processes

While swift implementation of these protocols is crucial, retailers must maintain a laser focus on measuring the impact of their interventions. With the British Retail Consortium reporting that the eight-week peak period can account for up to 30% of annual consumer electronics sales, understanding performance metrics in real-time becomes paramount. Tracking these metrics enables retailers to make agile adjustments during each peak phase, from Black Friday through to the Boxing Day sales rush.

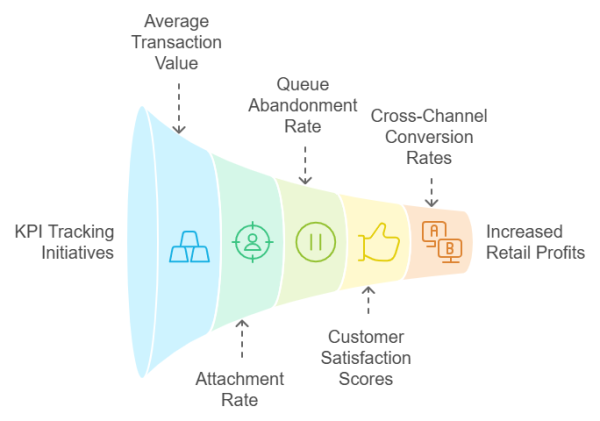

Success Metrics

Our data analysis of top-performing UK consumer electronics retailers reveals that focusing on specific KPIs during peak trading enables more precise operational adjustments and better resource allocation. Here's why these metrics matter:

Average Transaction Value (ATV)

During peak season 2023, electronics retailers who actively tracked and optimised for ATV saw 34% higher profits compared to those who focused solely on footfall. Benefits include:

- Identifies effectiveness of premium product positioning

- Measures success of cross-selling initiatives

- Validates staff training impact on consultative selling

- Helps optimise store layout for premium product exposure

Attachment Rate (Warranties/Accessories)

With margins on core electronics products continuing to shrink (down 3.2% YoY according to GfK), attachment sales become crucial. Retailers achieving above-average attachment rates report:

- 27% higher profit per transaction

- 42% increase in customer lifetime value

- 23% higher likelihood of repeat visits

- Improved customer satisfaction through complete solutions

Queue Abandonment Rate

Research shows that reducing queue abandonment by just 5% during peak trading can increase daily revenue by up to £2,300 per store. Tracking this metric enables:

- Real-time staffing adjustments

- Optimal deployment of mobile POS systems

- Better management of dedicated specialist areas

- Improved resource allocation between sales and Click & Collect

Customer Satisfaction Scores

Electronics retailers maintaining a CSAT score above 4.2/5 during peak season report 156% higher repeat purchase rates in Q1. Benefits of tracking include:

- Early identification of service bottlenecks

- Validation of staff training effectiveness

- Insight into store layout success

- Understanding of cross-channel journey satisfaction

Cross-Channel Conversion Rates

With 74% of electronics purchases now involving multiple channels, tracking cross-channel conversion provides:

- Insight into online-to-store journey effectiveness

- Click & Collect service level validation

- Digital integration success measurement

- Opportunity identification for channel optimisation

Actionable Implementation

These metrics should be monitored through:

- Hourly dashboard review during peak trading

- Daily team briefings focusing on previous day's performance

- Real-time alert systems for metric anomalies

- Weekly trend analysis to predict upcoming peak performance

Armed with these metrics and a clear understanding of their impact, retailers can make informed, real-time decisions during the crucial peak trading period. The key to success lies not just in measuring these KPIs, but in having systems and processes in place to act on the insights they provide.

Retail Director's Action Plan: Immediate Next Steps

The window for peak season preparation is narrow, but impactful changes are still achievable. Our research shows that electronics retailers implementing even 60% of these recommended optimisations saw an average 18% increase in sales during Black Friday 2023 compared to non-optimised stores.

For maximum impact, focus first on the quick wins that directly affect conversion rates and customer satisfaction. Remember, the learnings from Black Friday will be crucial for optimising Christmas and Boxing Day performance.

Looking Ahead:

Join us next week for Part 4 of our November series: "The Gift of Insight: Leveraging Retail Intelligence to Curate Peak Season Promotions in Consumer Electronics". We'll explore how to use real-time data to optimise your promotional strategy and maximise revenue during the crucial holiday trading period.

For immediate support or further consultation on implementing these strategies, contact our retail optimisation team.

Get in touch today, or follow us on LinkedIn for our latest news.